Housing

Black Family Sees Home Value Increase $500K After Erasing Themselves From Appraisal

There is a renewed focus on racism and structural inequality in the process of buying and selling homes after a Black couple shared their experience of how their home increased in value by half a million dollars when they had a white person stand in as the owner of the house.NBC News’ Jake Ward met with Tenisha Tate-Austin and Paul Austin and shares their story. Watch this video on YouTube!

#Inequality #Homebuying #HomeValue

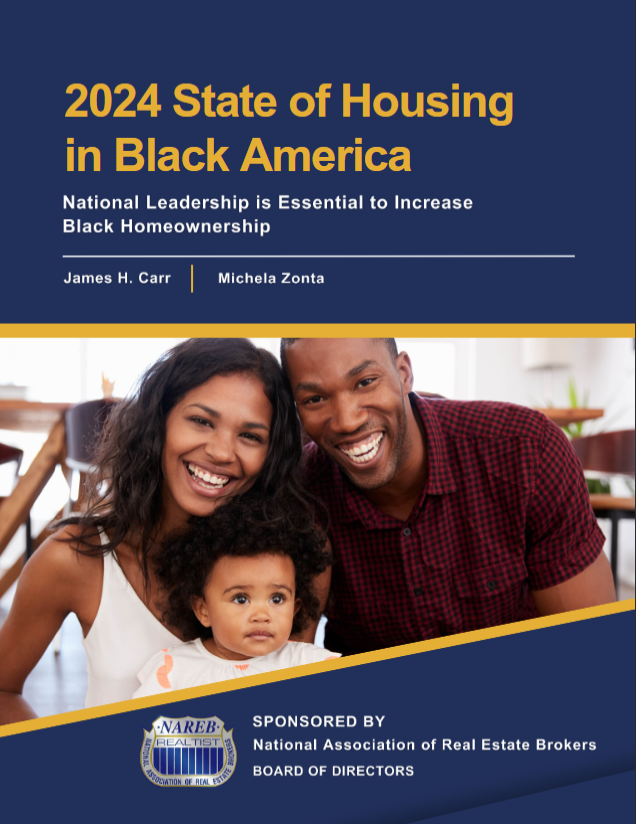

The homeownership rate for Black Americans in 2024 was 46.4%, according to the Federal Reserve Bank of St. Louis. This is much lower than the 75.8% homeownership rate for white Americans.

The racial gap in homeownership is the largest in a decade, according to the National Association of REALTORS®.

The homeownership rate for Black Americans has never reached 50%, unlike other racial and ethnic groups.

The history of redlining and predatory lending practices has created a racially discriminatory housing system that continues to impact Black Americans.

Black renter households are more likely to be severely cost burdened, spending over half of their income on housing.

Black renter households are also more likely to be behind on housing payments and at risk of eviction.

Homeownership rates vary by state, with some states having higher rates for Black Americans than others.

Three Current Issues That Are Facing Black Homeowners

Black Homeowners: You now have a right to negotiate a price with your realtor on how much commission they will receive when selling or buying a house. NBCI says 5.5 % of the sale

1. Big Changes to How You Buy and Sell a Home Go Into Effect Today: What You Need to Know

.pdf 1.6mb A new set of rules governing how most real estate professional do business in the US officially takes effect - and the changes could potentially upend how Amercians buy and sell homes. The rules are designed to transform the way Realtors get paid and who pays them.Click this link to read the entire article!

2. No State Has an Adequate Supply of Affordable Rental Housing for the Lowest-Income Renters

.pdf 306kb The U.S. has a shortage of 7.3 million rental homes affordable and available to renters with extremely low incomes – that is, incomes at or below either the federal poverty guideline or 30% of their area median income, whichever is greater.Only 34 affordable and available rental homes exist for every 100 extremely low-income renter households. Extremely low-income renters face a shortage in every state and major metropolitan area.

Read this article here.

Black renter households also face disparities in accessing safe, affordable, and stable housing. In 2020, Black renter households were the most likely to be severely cost burdened, spending over 50 percent of their income on housing. As a result, Black renter households in particular were twice as likely as white renter households to be behind on housing payments and twice as likely to report being at risk of eviction.

What are Cities Doing?

Cities and local governments across the country have developed programs to increase housing equity for Black homeowners and renters. From financial assistance to eviction prevention, cities should foster holistic approaches to expanding housing access for Black individuals and families and address historic discriminations in the housing market. Such program examples include:- Expanding affordable housing supply and affordable homeownership opportunities.

- Incentivizing more holistic approaches to evaluating potential homebuyers. Local policy makers can develop better solutions and policies to help Black-led households be more competitive in the housing market, including changes to credit scoring and Special Purpose Credit Programs.

- Expanding the availability of Down Payment Assistance programs to increase Black homeownership rates, particularly in high-cost metro areas. It is also important for cities to aggregate exiting programs and reduce barriers to entry to make programs more accessible to those who are eligible.

- Creating and expanding right to counsel legislation, expungement of eviction records, and other eviction prevention policies that lessen the consequences of eviction on Black renters.

All of these programs may be in JEOPARDY because of the Trump Administration Cuts

What’s Next for Cities?

Cities must look to programs and policies that uplift Black homeowners and renters in their journey through accessing stable housing and building wealth. Local solutions cities should consider are:- Expanding affordable housing supply and affordable homeownership opportunities.

- Incentivizing more holistic approaches to evaluating potential homebuyers. Local policy makers can develop better solutions and policies to help Black-led households be more competitive in the housing market, including changes to credit scoring and Special Purpose Credit Programs.

- Expanding the availability of Down Payment Assistance programs to increase Black homeownership rates, particularly in high-cost metro areas. It is also important for cities to aggregate exiting programs and reduce barriers to entry to make programs more accessible to those who are eligible.

- Creating and expanding right to counsel legislation, expungement of eviction records, and other eviction prevention policies that lessen the consequences of eviction on Black renters.

Over the past five years we have worked with JP Morgan Chase and other financial institutions to provide homeowner education focusing specifically on educating first-time home buyers. One project, CommunityBuilt, brings together churches, community leaders, civic organizations and the National Realtor Association to strengthen communities through strong housing and civic pride. We would welcome the opportunity to work with your firm to expand this extraordinary program to an additional 50 cities.

Over the past five years we have worked with JP Morgan Chase and other financial institutions to provide homeowner education focusing specifically on educating first-time home buyers. One project, CommunityBuilt, brings together churches, community leaders, civic organizations and the National Realtor Association to strengthen communities through strong housing and civic pride. We would welcome the opportunity to work with your firm to expand this extraordinary program to an additional 50 cities. CommunityBuilt in founded on three building blocks:

- Work with city leaders and key housing experts and community stakeholders to make foreclosed homes available to middle class families.

- Provide those families with financial literacy classes and emphasize the mortgage first principle, and continue to mentor these families over a ten year period.

- Each family served in turn commits two years of volunteer service towards the goal of Community Built.

We are in need of a grant of one million dollars to sustain this extraordinary momentum to continue to help these families and build strong communities.

Meeting identifies current needs, and addresses gaps in existing solutions.

What Home Sellers Don't Tell Buyers

Here are some of the common fibs buyers may hear as they shop for a houseAs buyers ease back into the battered real-estate market, they’re often hitting a stumbling block: fibbing by home sellers.

10 Rookie Home Buyer Mistakes to Avoid

by Kimberly CastroWith the extension and expansion of the popular first-time home buyer tax credit, which President Obama signed into law in November, as well as price declines and attractive mortgage rates, an influx of qualified first-time buyers are rushing to take advantage of the market. Mark Zandi, the chief economist at Moody's Economy.com, projects there will be 1.84 million home sales to first-time home buyers in 2010, compared with 1.73 million in 2009. If you're a property virgin about to take the plunge, here are some common blunders to avoid?and helpful tips that could mean the difference between financial security and a mountain of debt:

National Black Church Initiative Foreclosure Prevention Guide

This user-friendly booklet is designed to provide congregants and the public with critical and helpful information on how to keep their home. The booklet will consist of a list of government-based agencies and private lenders that can assist at risk borrowers.

This user-friendly booklet is designed to provide congregants and the public with critical and helpful information on how to keep their home. The booklet will consist of a list of government-based agencies and private lenders that can assist at risk borrowers.

This step-by-step guide will also help them to identify resources in the housing industry that have been created for the explicit purpose of assisting homeowners who are touched by the current difficulties. The booklet contains websites, phone numbers, lists of individuals and institutions that can help borrowers navigate through this housing turbulence.

Order this booklet for the residents of your state, county or city now!

Call 1-202-744-0184

Foreclosure in the Nation's Capital: How Unfair and Reckless Lending Undermines Homeownership

Like the foreclosure crisis nationwide, the DC crisis has been driven by subprime and nontraditional lending. Subsequently, neighborhood decay accelerates, due to loss of property tax revenue, decline of home values, and increased crime and vandalism. The importance of these transformations can hardly be overstated; as the latest report from Pew's Economic Mobility Project indicates, neighborhood conditions are the strongest predictor of adults' upward or downward economic mobility.

This paper focuses on two major issues outlined above. First, it focuses on potential disparities in subprime lending that are not explained by borrowers' financial qualifications or housing market characteristics. Then, the paper turns its attention to the impact of such lending disparities, among other factors, on foreclosure outcomes.

Foreclosure Rescue Scams: A Nightmare Complicating the American Dream

Each year counselors within the National Community Reinvestment Coalition (NCRC) Housing Counseling Network assist thousands of consumers. US Department of Housing and Urban Development certified housing counselors understand that for each and every family we counsel, the possibility of losing their home to foreclosure is real and terrifying. However, the reality that scam artists are preying on the vulnerability of desperate homeowners is equally frightening.

This report identifies common scams perpetrated against consumers, including phantom help, reverse mortgages, title theft, and

short sale fraud, and highlights those important red flags that every homeowner must know. In addition, NCRC's findings demonstrate

that an aggressive legislative solution and added public and private oversights and enforcement is necessary to prevent consumers

from being harmed.

Opening the Door to a Home of Your Own

If you're like most Americans, owning your own home is a major part of the American dream. The Fannie Mae Foundation wants to help you understand the steps you have to follow to reach that dream. Homeownership is a big responsibility, one that you will need to accept for many years to come. It's worth the effort, and the Fannie Mae Foundation can help.

You may not be familiar with us. We were formed and funded by Fannie Mae, which is a private company chartered by Congress to provide funds to local lenders for home mortgages in communities across America.

The Fannie Mae Foundation is a nonprofit organization. Among other activities, the Foundation provides information useful to Americans who want to buy a home. We know that the whole process of getting a mortgage can be confusing, so an important service we provide is information such as this guide.

Consumer Guide to Affordable Housing

On behalf of the Michigan Mortgage Lenders Association (MMLA) Consumer Education Committee, we would like to take a moment to thank you for spending time with us and learning more about the home-buying process. We are committed and dedicated to the real estate finance profession and want to make a positive impact on the lives of as many residents as possible in the state of Michigan. We hope that you find the content of this Consumer Guide to be helpful as you begin the process of becoming a homeowner.

Please keep this consumer Guide in a safe and convenient location where you can reference it in the future for information, or pass it along to others you know who might be interested in learning more about the home-buying process.

Teaching African Americans to Budget, Save and Plan for the Future

The SHIBA Report is very comprehensive. It provides a detail view into the real numbers and facts that impact and impede Black families from realizing the dream of homeownership. NAREB is committed to changing the statistics through our members and industry relationships. Our goal is to continue to show Black families the issues which affect them, and bring solutions to overcome these barriers.

The SHIBA Report is very comprehensive. It provides a detail view into the real numbers and facts that impact and impede Black families from realizing the dream of homeownership. NAREB is committed to changing the statistics through our members and industry relationships. Our goal is to continue to show Black families the issues which affect them, and bring solutions to overcome these barriers.